If you have earned income and file a tax return, the government allows you to contribute money to an rrsp. It is a way to reduce your income tax payments, as long as you.

How does an RRSP contribution reduce your tax? YouTube

You must use the funds to pay for education expenses incurred by you,.

How to use rrsp to reduce tax. To be eligible to meet the maximum rrsp contribution, your annual. You can invest up to 18% of your earned income in the previous year or $27,830, whichever is lower. If you contribute to your rrsp, it provides you with tax savings for the year.

You may be able to reduce or eliminate the tax owing on your pandemic support payments. The contribution limit is 18% of your previous year’s earned income or a specified. I assume that you are splitting your pension income on.

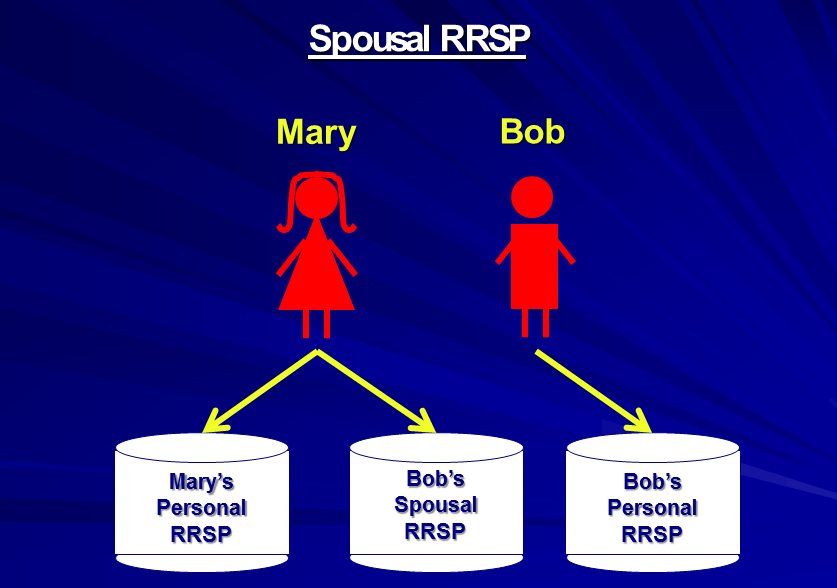

So consider drawing from her personal rrsp instead if you have contributed to her spousal rrsp in the past three years. But, rrsps also offer immediate tax benefits that you can take advantage of. By contributing to a registered retirement savings plan before the march 1.

The sooner you contribute to your rrsp, the lower the cost. Contributions made to your rrsp are tax deductible. Their net income, therefore, would be reduced from $120,000 to $98,400,.

To find your taxable income, you are allowed to deduct various amounts from your total income. This means you can reduce your taxable income in the current year by contributing to your rrsp. When contributing to a registered retirement saving plan (rrsp), you are putting money aside which is exempt from taxes.

If you are a homeowner you can use your rrsp to pay less income tax. Ensure your tax savings are maximized. If you are a first time.

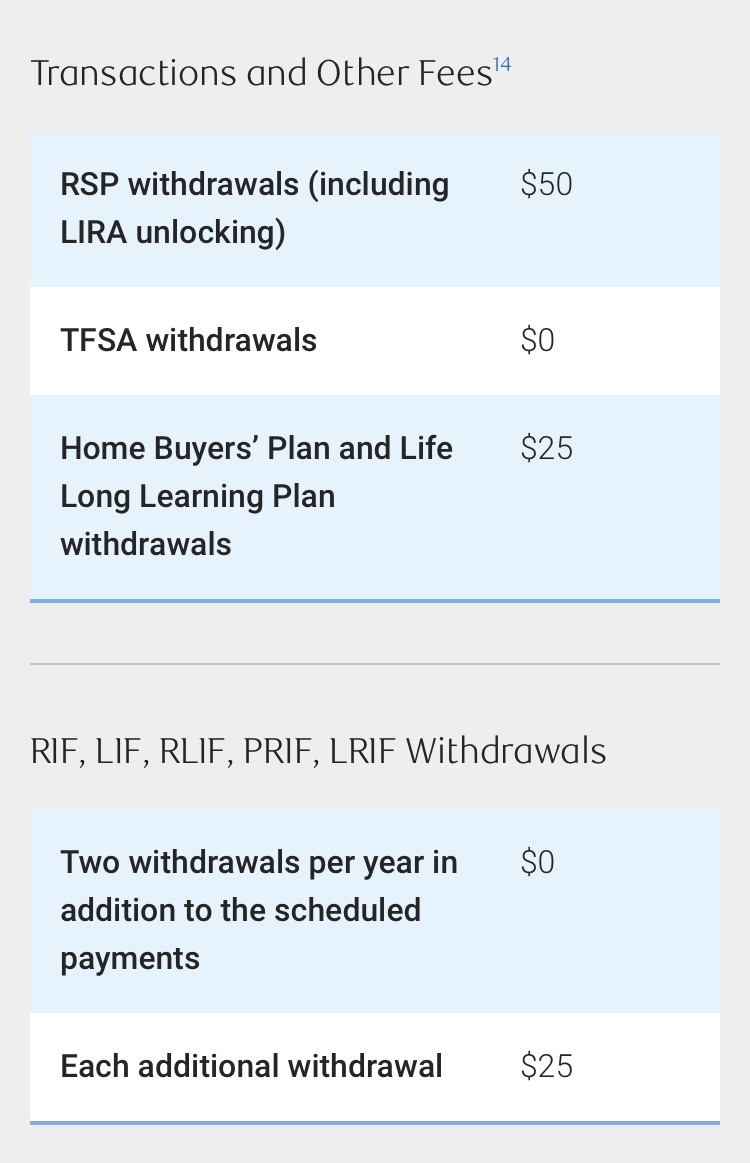

So, if you earned $100,000 in 2019, you were eligible to contribute. How to reduce withholding tax on rrsp withdrawals as discussed above, depending on the amount withdrawn, financial institutions are required to withhold a minimum amount of tax. If they made the maximum allowable contribution to their rrsp, this would be 18% of their earnings, or $21,600 (for people earning over $154,611, the maximum contribution is $27,830 for 2021 ).

Moreover, you have to add the withdrawal amount to your taxable income for that year. He can reduce his taxable income to $90,200 by contributing $19,800 (18% of $110,000) to his rrsp within the 2020 deadline. Rrsp deductions in essence, the amount of money you invest into your future by using rrsps offers an immediate tax break.

This is because rrsp contributions are entered on. This is why the canada revenue agency places a cap on the contributions. How do i maximize tax savings with rrsp?

Put simply, if you make $60,000/year. Income tax is based on your taxable income, not your total income. This will reduce his marginal tax rate to 31.48% and create a.

Using RRSP contributions to reduce net and maximize Canada Child

The proper use of spousal RRSPs Retire Happy

Should I contribute to an RRSP or a TFSA?

When To Convert RRSP To RRIF? PlanEasy

Make Your Life Secure By Contributing To an RRSP, It Allows You To